Read and get Inspired

1. Mukesh Ambani

Makes debut as India's richest, despite fact that net worth fell $28.2 billion in past year as stock price of petrochemicals flagship Reliance Industries tanked. Unfazed, Mukesh upped Reliance stake, paying $3.4 billion to convert 120 million preferential warrants into shares, at a premium to stock price. Legal spat with estranged brother Anil over gas supply agreement still unresolved.

Makes debut as India's richest, despite fact that net worth fell $28.2 billion in past year as stock price of petrochemicals flagship Reliance Industries tanked. Unfazed, Mukesh upped Reliance stake, paying $3.4 billion to convert 120 million preferential warrants into shares, at a premium to stock price. Legal spat with estranged brother Anil over gas supply agreement still unresolved.2. Lakshmi Mittal

Stock of world's largest steel outfit, ArcelorMittal, which he heads, spiraled to 4-year lows amid falling steel prices. In November announced plans to cut output, reduce debt. Mittal joined Goldman Sachs board in June. Has stakes in Indiabulls, RAB Capital.

Stock of world's largest steel outfit, ArcelorMittal, which he heads, spiraled to 4-year lows amid falling steel prices. In November announced plans to cut output, reduce debt. Mittal joined Goldman Sachs board in June. Has stakes in Indiabulls, RAB Capital.3. Anil Ambani

Plans to merge his Reliance Communications with South Africa's MTN in what would have been India's largest-ever overseas deal were scuttled in July after brother Mukesh threatened to sue, claiming he had right of first refusal. Stock stumbled 48% since. Married to a onetime Bollywood actress, Anil has Hollywood ambitions: His Reliance Entertainment is investing $500 million in a new studio venture with Steven Spielberg's DreamWorks.

Plans to merge his Reliance Communications with South Africa's MTN in what would have been India's largest-ever overseas deal were scuttled in July after brother Mukesh threatened to sue, claiming he had right of first refusal. Stock stumbled 48% since. Married to a onetime Bollywood actress, Anil has Hollywood ambitions: His Reliance Entertainment is investing $500 million in a new studio venture with Steven Spielberg's DreamWorks.4. Sunil Mittal

Runs Bharti Group whose Bharti Airtel is country's largest mobile phone operator. In May backed out of deal to take over South Africa's MTN, opening door for Anil Ambani's failed bid. Launched Airtel Digital TV, a direct-to-home digital television service. Joint venture with Wal-Mart expected to open its first store next year. Funding soccer academy.

Runs Bharti Group whose Bharti Airtel is country's largest mobile phone operator. In May backed out of deal to take over South Africa's MTN, opening door for Anil Ambani's failed bid. Launched Airtel Digital TV, a direct-to-home digital television service. Joint venture with Wal-Mart expected to open its first store next year. Funding soccer academy.5. Kushal Pal Singh

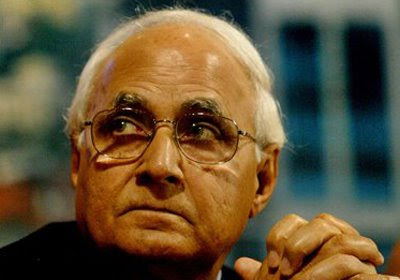

Real estate baron and DLF chairman lost $27.2 billion in past year. Attempt to boost share price through share buyback was unsuccessful as were its plans to list its real estate investment trust in Singapore. Company paid $40 million in February to sponsor new cricket league for 5 years.

Real estate baron and DLF chairman lost $27.2 billion in past year. Attempt to boost share price through share buyback was unsuccessful as were its plans to list its real estate investment trust in Singapore. Company paid $40 million in February to sponsor new cricket league for 5 years.6. Shashi Ravi Ruia

Brothers' Essar Group's most valuable asset is 33% stake in mobile phone operator Vodafone Essar, India's third largest. Also own 8% in rival telecom firm BPL Mobile. Lost out to Russian firm Severstal in bid for steelmaker Esmark this year. Other holdings in shipping, oil, construction, power.

Brothers' Essar Group's most valuable asset is 33% stake in mobile phone operator Vodafone Essar, India's third largest. Also own 8% in rival telecom firm BPL Mobile. Lost out to Russian firm Severstal in bid for steelmaker Esmark this year. Other holdings in shipping, oil, construction, power.7. Azim Premji

Longtime head of $4.9 billion (revenues) Bangalore outsourcing giant Wipro, handed over operations to 2 co-chief executives in April. Remains chairman. Hit by global economic slowdown, stock is down 44% in past year.

Longtime head of $4.9 billion (revenues) Bangalore outsourcing giant Wipro, handed over operations to 2 co-chief executives in April. Remains chairman. Hit by global economic slowdown, stock is down 44% in past year.8. Kumar Birla

Head of Aditya Birla Group, commodities conglomerate inherited from father, with operations in 25 countries. His telecom outfit bought 50% of mobile operator Spice Communications. In October a rights issue by its aluminum maker Hindalco unraveled as its stock price plunged to alltime low.

Head of Aditya Birla Group, commodities conglomerate inherited from father, with operations in 25 countries. His telecom outfit bought 50% of mobile operator Spice Communications. In October a rights issue by its aluminum maker Hindalco unraveled as its stock price plunged to alltime low.9. Adi Godrej

Third generation head of Godrej Group, a consumer products conglomerate which makes locks, soaps, mosquito repellants, furniture and foods. In major image makeover, group logo was changed for the first time since it was founded 111 years ago. Following the easing of decades-old land ownership restrictions, Godrej has outlined ambitious plans to develop family's 3,500 acre estate in suburban Mumbai. Son Pirojsha, a Columbia grad, works in property arm.

Third generation head of Godrej Group, a consumer products conglomerate which makes locks, soaps, mosquito repellants, furniture and foods. In major image makeover, group logo was changed for the first time since it was founded 111 years ago. Following the easing of decades-old land ownership restrictions, Godrej has outlined ambitious plans to develop family's 3,500 acre estate in suburban Mumbai. Son Pirojsha, a Columbia grad, works in property arm.10. Gautam Adani

Dropped out of college to start a trading outfit 20 years ago. Now his Adani Enterprises has interests in edible oils, power, infrastructure. Owns Mundra Port, India's largest in private sector. Fishermen recently took Adani to court over special economic zone he's building on western coast; court ruled in his favor. Plans to list power subsidiary are delayed.

Dropped out of college to start a trading outfit 20 years ago. Now his Adani Enterprises has interests in edible oils, power, infrastructure. Owns Mundra Port, India's largest in private sector. Fishermen recently took Adani to court over special economic zone he's building on western coast; court ruled in his favor. Plans to list power subsidiary are delayed.

0 comments:

Post a Comment